Understanding Your Property Revaluation and What It Means for Taxes

- Amanda Gabriele

- Nov 19, 2024

- 3 min read

If you recently received your property revaluation, you may be concerned about the potential impact on your taxes. With property values in North Haven increasing nearly 30% over the past five years, it’s understandable that residents are asking questions. Let’s break down what this means, how property taxes are calculated, and how higher home values can actually benefit you.

How Are Property Taxes Calculated?

Your property taxes are determined by two main factors:

The Assessed Value of Your PropertyThis is the value of your home determined by the town's revaluation process, which happens every five years. It’s important to note that your assessed value is 70% of your home’s market value.

The Mill RateThe mill rate is the amount of tax you pay per $1,000 of assessed value. For example, if the mill rate is 30 and your property’s assessed value is $100,000, your annual property tax would be $3,000.

However, when property values rise across the town, the mill rate typically decreases to offset the increase in home values, ensuring that the town collects roughly the same amount of revenue as before. This adjustment is key to understanding how revaluation affects your taxes. As an example, after the last North Haven homes underwent a revaluation, the mill rate dropped from 31.18 to 30.72 (-.46 mils).

What Happens After a Revaluation?

The revaluation process is not tied to the current mill rate. While your home’s assessed value may have increased, the mill rate will be recalculated during the budget process to account for the updated property values town-wide.

Despite what some may believe, the revaluation process is revenue neutral. This means that the Town of North Haven doesn't gain additional tax revenue through the process. It is done to ensure taxation is fair and that each person is paying a proportionate amount based on property.

In many cases, this means that your taxes may not increase by the same percentage as your home value. The impact on your taxes depends on how your property’s value changed compared to the average change in North Haven.

If your home value increased more than the town average, your taxes may rise.

If your home value increased less than the town average, your taxes may stay the same or even decrease.

The North Haven Democratic Town Committee put together this handy model to help you estimate your property taxes based on adjustments to the mill rate. Check it out here.

The Benefits of Rising Home Values

While rising property values can cause concern about taxes, they also reflect positive trends in our community. Higher home values can mean:

Increased Equity: Your home is likely one of your most valuable investments. Rising values mean more equity in your property, which benefits you if you decide to sell, refinance, or take out a loan. Home equity loans and lines of credit often have significantly lower interest rates compared to other short term credit accounts.

Community Growth: Higher property values often signal a desirable place to live, attracting businesses, improving schools, and enhancing community resources.

What’s Next?

The new assessments won’t take effect until the next fiscal year’s budget is adopted, and the mill rate is recalculated. In the meantime:

Attend public hearings during the budget process to learn more about how the town sets the mill rate.

Reach out to local representatives with questions or concerns—they’re here to help!

Stay informed about how your property compares to the town average to understand what changes you might expect.

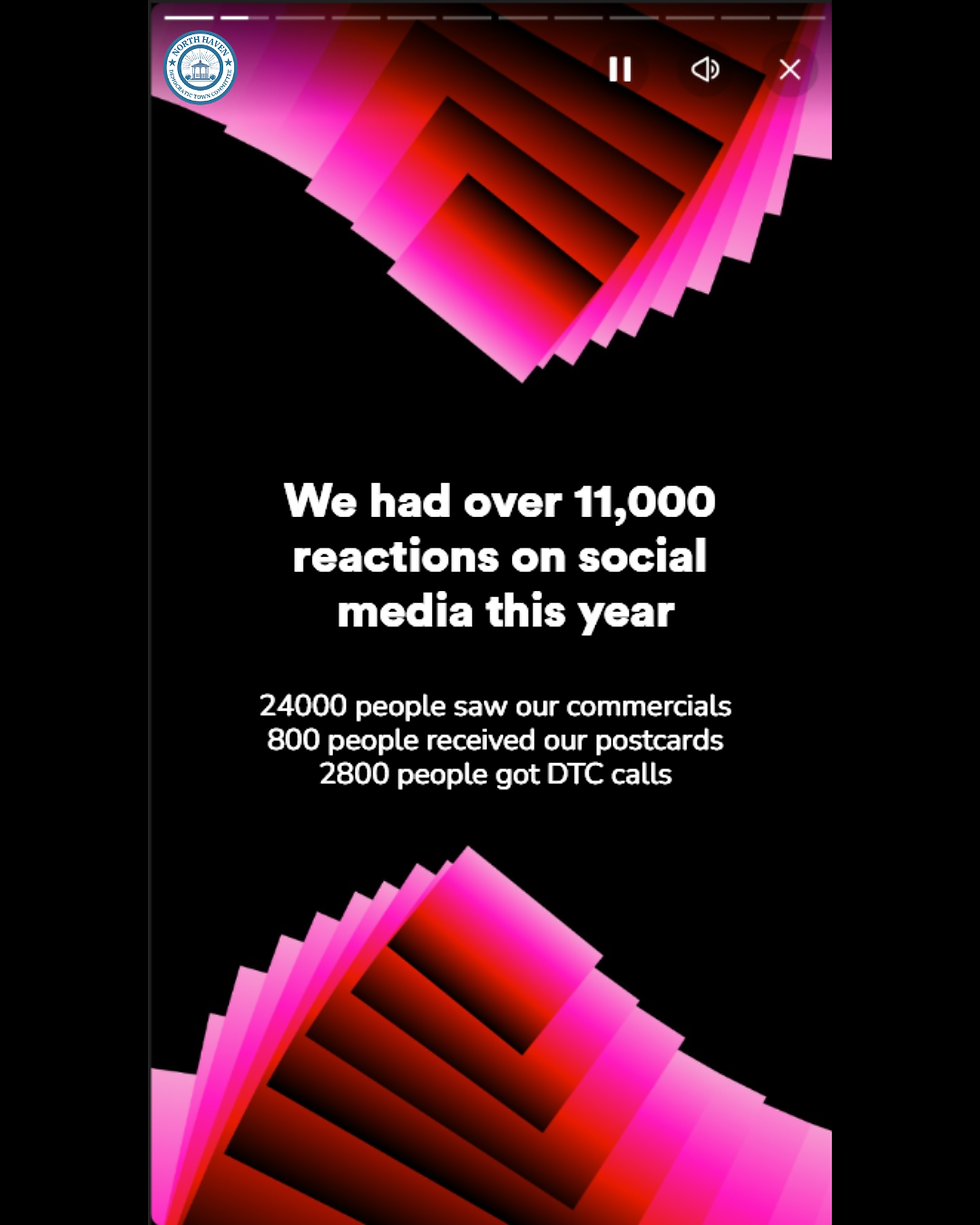

At the North Haven Democratic Town Committee, we’re committed to transparency and advocating for fair policies that protect all residents. If you have questions about the revaluation process or how taxes are determined, don’t hesitate to reach out. Together, we can ensure North Haven remains a great place to live, work, and thrive.

Comments